Imagine this: your fridge notices you’re low on milk and quietly orders it for you. Your car glides through a toll booth, paying automatically, without a second thought from you. This isn’t science fiction — it’s the new world of IoT payments and microtransactions, where devices aren’t just smart; they’re starting to handle money on their own. And honestly, it’s both exciting and a little surreal.

From big purchases to tiny, endless payments

We’re used to swiping our cards, confirming a transaction, and waiting for a receipt. But what if that process disappears entirely? IoT devices are now stepping in, making tiny payments on their own — sometimes for amounts so small, they barely register: fractions of a cent.

Think of it:

-

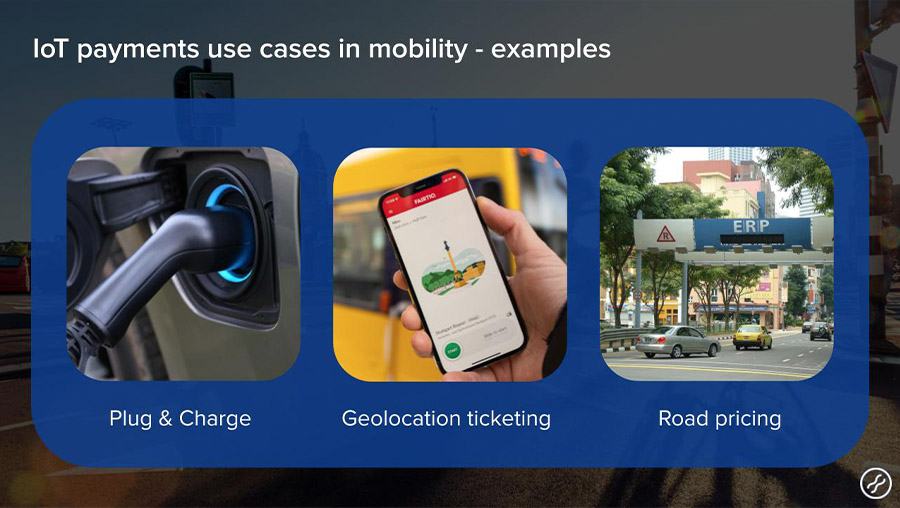

- A car paying for parking or tolls without the driver lifting a finger.

-

- A smart home device ordering groceries just before you run out.

-

- Factory sensors automatically paying for services or data as needed.

This shift is profound. Microtransactions aren’t just about paying small amounts — they’re about creating a continuous, invisible flow of value. It’s a world where machines quietly handle the little things, freeing humans from the friction of daily payments.

Why now — why this is happening

Several factors are colliding to make this possible:

-

- More connected devices than ever – our world is crawling with endpoints ready to transact.

-

- Hardware and network costs dropping – the technology to connect and pay is finally affordable.

-

- Our craving for frictionless experiences – convenience is king. Why bother manually paying when a device can do it for you?

-

- New payment infrastructures – blockchains and other modern systems reduce fees and make microtransactions realistic.

Even research shows promising results. Imagine a coffee machine that pays the coffee supplier autonomously via blockchain. Tiny payments, happening seamlessly, with no human intervention — it’s an elegant dance of technology and money.

Opportunities abound

The potential is huge:

-

- New business models: pay per minute, per use, or per action. Suddenly, subscription fatigue is replaced by precise, fair pricing.

-

- Devices as revenue generators: your gadgets aren’t just tools anymore; they’re tiny economic agents.

-

- Global inclusion: microtransactions open doors for low‑value payments in markets where traditional methods are too costly.

-

- Automation at its finest: humans get to step back while machines handle the mundane.

But let’s be real — it’s not all smooth sailing

Challenges abound.

-

- Transaction cost vs. value: a payment shouldn’t cost more to process than it’s worth.

-

- Security and trust: tiny devices aren’t always secure. Keeping them safe from hacks is tricky.

-

- Scalability: hundreds of thousands of microtransactions per minute? The infrastructure has to keep up.

-

- Standards and interoperability: every device, platform, and network needs to speak the same language.

-

- Regulations: the rules weren’t written for machines buying stuff for us. Privacy, fraud prevention, and compliance all need updating.

It’s a fascinating dance — exciting, but also full of tension.

Real-world examples that feel like tomorrow

-

- Smart cars paying tolls and parking automatically — no wallets, no stops, just smooth roads.

-

- Vending machines that accept micro-payments from your phone or another device, buying only exactly what you need.

-

- Home appliances paying for electricity, laundry detergent, or even internet data — quietly, efficiently, and automatically.

One experiment integrated a coffee machine with blockchain-based micropayments. The result? Devices paying each other autonomously, creating a tiny but significant economy. It’s small, but it’s a glimpse into a future where we barely touch money — and life just works.

What comes next

For IoT payments to truly take off, a few things must happen:

-

- Ultra-low fees — microtransactions are pointless if they cost more than their value.

-

- Secure device identity — machines must trust each other without human babysitting.

-

- Offline and edge solutions — payments need to happen even with weak or intermittent connectivity.

-

- Business models built around microvalue — subscriptions and packages give way to precise, flexible charges.

-

- Regulatory clarity — rules must adapt to a world where devices pay and humans hardly notice.

-

- Partnerships and ecosystems — device makers, payment providers, and regulators must work together.

Why it matters

This isn’t just a tech trend; it’s a paradigm shift. The intersection of IoT, finance, and the internet is redefining how value moves in the world. Devices aren’t just tools anymore. They’re participants in the economy.

For banks and fintechs, this means handling countless tiny payments at high speed. For tech companies, it’s time to think of gadgets as autonomous economic actors. And for regulators, it’s about rethinking the very definition of a “payment.”

Wrapping it up

IoT microtransactions are here, and they’re quietly changing everything. Devices paying for things on their own may seem small, but the impact on commerce, business models, and daily life could be enormous. The age of tiny, invisible payments is dawning — and with it, a world where value flows more freely, seamlessly, and effortlessly than ever before.

It’s a brave new frontier. Our devices are no longer just ours; they’re active, smart, and increasingly capable of handling the little, vital details of life. And for us? Well, it’s time to sit back and watch — your fridge might just take care of dinner tonight.

Want to know about ESG in FinTech? Learn more