The financial world is changing—and fast. Decentralised autonomous organisations (DAOs) are no longer just a cool experiment for crypto enthusiasts. They’re stepping into the spotlight, shaking up how banks, asset managers, and insurers operate. Some see DAOs as a thrilling opportunity; others, a risky puzzle. Either way, the industry can’t afford to ignore them.

What’s a DAO, Really?

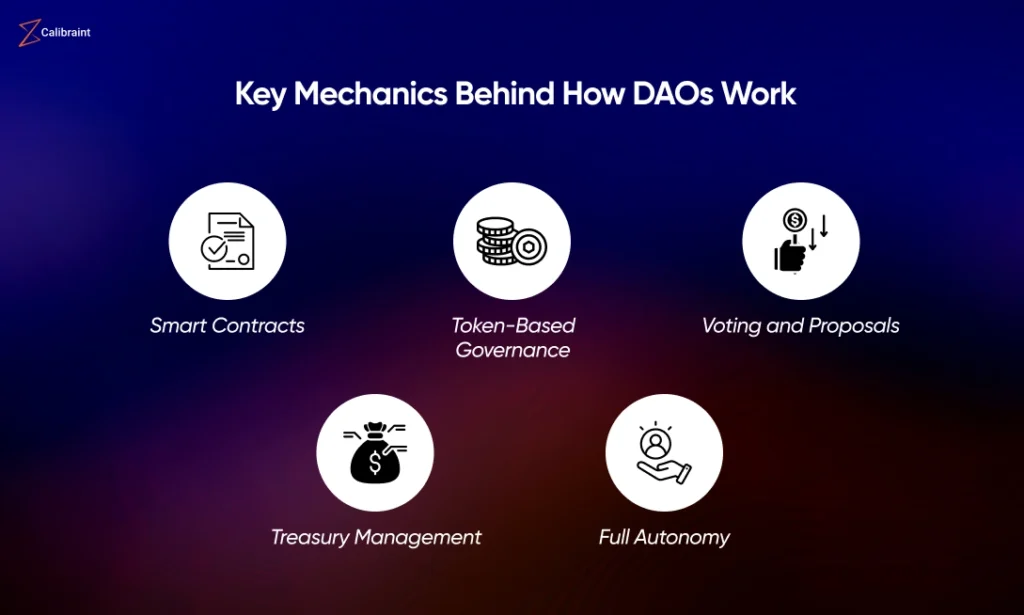

Let’s keep it simple. A DAO is an organisation run by code on a blockchain, not a CEO or a boardroom full of suits. Decisions aren’t made behind closed doors—they’re voted on by members holding governance tokens. Money moves automatically via smart contracts, and transparency is baked in.

Sounds futuristic? Absolutely. And yet, it’s more than tech hype. DAOs challenge the old ways of doing business, promising faster decisions, lower costs, and a more democratic approach to managing money. As one blockchain enthusiast put it, “DAOs are the wake-up call traditional finance didn’t know it needed.”

How DAOs Are Shaping Financial Services

The possibilities are exciting:

- Treasury and asset management: Imagine a fund where everyone with a token has a voice. Token-holders vote, money moves according to smart contracts, and returns are shared transparently. No middleman, no unnecessary bureaucracy.

- Banking and payments: Some DAOs now offer wallet services, fiat on-ramps, and invoicing. They blur the line between Web3 innovation and conventional finance.

- DeFi governance: Many decentralised finance platforms are DAOs at heart. Lending, borrowing, and trading decisions are voted on by the community. It’s finance, but rewritten.

- Bank-DAO hybrids: Forward-thinking financial institutions are experimenting with DAO-style governance for niche projects, special funds, or even customer engagement.

The common thread? Power to the people. Or at least, to those willing to participate.

Why People Are Excited

DAOs aren’t just a novelty—they offer real advantages:

- Transparency you can see: Every vote, every transaction is recorded on-chain. No more guessing what happens behind the curtain.

- Alignment of interests: Token-holders have a say. This isn’t just about money; it’s about influence.

- Efficiency through automation: Smart contracts handle routine operations automatically, freeing people to focus on decisions that matter.

- New ways to play: From community-governed funds to decentralised insurance pools, DAOs allow creativity in financial services like never before.

But It’s Not All Sunshine

For all the promise, DAOs have their dark corners:

- Legal grey zones: Many countries don’t know how to treat DAOs. Who’s responsible if something goes wrong? The law hasn’t caught up yet.

- Governance headaches: Decentralised doesn’t mean flawless. Low participation or whale token-holders dominating votes can stall progress.

- Security nightmares: Hackers have struck DAOs before. A single vulnerability can cost millions.

- Integration struggles: Traditional banks don’t just switch to DAO overnight. Legacy systems, compliance, and risk management are tough to bridge.

It’s like standing at the edge of a cliff: thrilling, but you need to know where you’re stepping.

The Road Ahead for Finance

So, what happens next? The path is likely gradual, with hybrid approaches emerging:

- Financial firms might test DAO governance in specific areas like venture funds or tokenised assets.

- Regulators will start paying closer attention, especially when DAOs offer services like lending or treasury management.

- Hybrid models—legal entities with DAO governance layers—will probably dominate, balancing code-driven decision-making with regulatory compliance.

- For users, DAOs promise more inclusion, lower costs, and innovative services—but risks remain real, from hacks to governance deadlocks.

Lessons for Stakeholders

Anyone thinking about DAOs should consider:

- Design matters: Token distribution, quorum rules, and treasury control aren’t just technical—they define power dynamics.

- Legal clarity is critical: If your DAO offers financial services, make sure the law recognises your setup.

- Security first: Audits, wallet controls, and smart-contract checks are non-negotiable.

- Integration is a puzzle: Blending off-chain compliance with on-chain operations takes careful planning.

- User engagement drives success: A DAO only works if people show up and vote. Without participation, it’s just code sitting idle.

Final Thoughts

DAOs are more than a trend—they’re a peek into finance’s future. Transparent, automated, and participatory, they offer a vision that’s thrilling and intimidating all at once. Traditional institutions may not disappear tomorrow, but the ones that embrace experimentation could unlock incredible opportunities.

The question isn’t if DAOs will reshape finance. It’s how—and whether we can do it safely, responsibly, and sustainably. For anyone in financial services, ignoring DAOs is no longer an option.

Curious about how blockchain is transforming personal identity too? Check this out